Weak UK economic data add to cable’s negative outlook

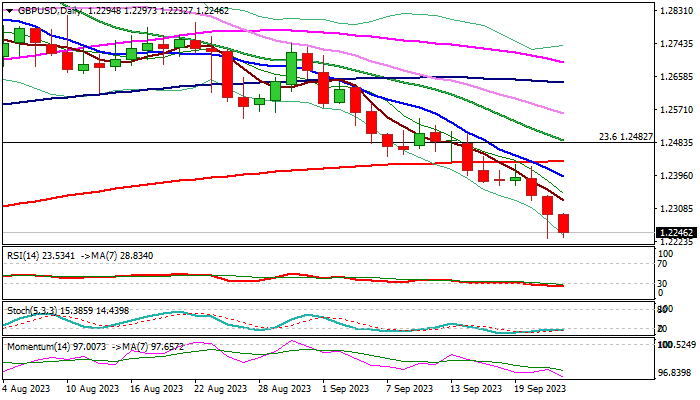

Bears tightened grip on Friday, offsetting initial positive signal of Thursday’s long-tailed daily candle, formed on post-BoE dip and subsequent bounce.

Fresh weakness is pressuring six-month low (1.2231) and nearby 55WMA (1.2204) which produced headwinds on Thursday, on track to break these supports and extend larger bear-leg from 1.3141 (2023 high) towards targets at 1.2074/00 (Fibo 38.2% of 1.0348/1.3141 uptrend / psychological).

Increasingly bearish technical picture on daily chart points to negative near-term outlook, with downside pressure being boosted by weaker than expected UK Aug retail sales and drop of UK services PMI well below forecast, which blows expectations of those advocating further BoE rate hikes.

However, strongly oversold conditions warn that bears may take a breather for limited consolidation, before resuming, as the pair is on track for another big weekly loss, which maintains downside pressure.

Res: 1.2297; 1.2332; 1.2393; 1.2433

Sup: 1.2231; 1.2204; 1.2074; 1.2000