WTI OIL eases after six-day rally; risk of stronger weakness on trade war concerns

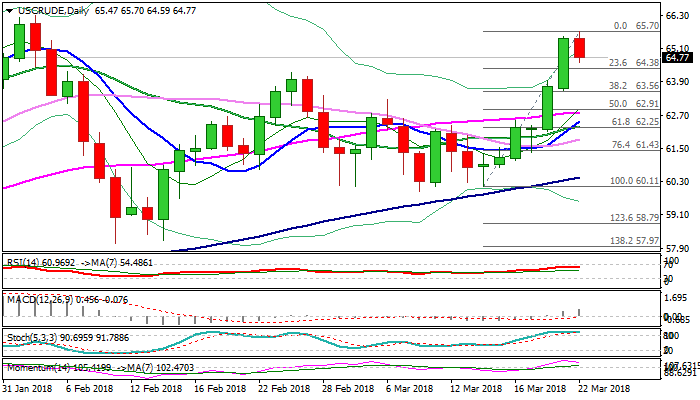

WTI oil price eases on Thursday after hitting marginally higher high at $65.70 (the highest since early Feb) in uninterrupted six-day rally.

Strong bullish sentiment could be soured by rising concerns about import tariffs on China, which could trigger stronger correction of $60.11/$65.70 ascend.

Overall structure remains firmly bullish and current easing could be seen as corrective action on overbought conditions (slow stochastic reverses in deep overbought territory).

Initial supports at $64.38/22 (Fibo 23.6% of $60.11/$65.70 rally / 26 Feb former high) are still intact, with deeper dips expected to find ground at $63.56 (Fibo 38.2% / Wednesday’s low) to keep bullish structure intact for fresh attempts higher and final push towards target at $66.64 (25 Jan peak).

Conversely, close below $63.56 would generate negative signal and risk further easing towards rising 55SMA at $62.79.

Res: 65.23; 65.53; 65.70; 65.85

Sup: 64.38; 64.22; 63.56; 63.26