WTI price dips after Saudi and Gulf allies announced halt of voluntary additional production cuts

WTI oil dipped on Monday (down around 3% since Asian opening) on Monday after unsuccessful first attempt through psychological $40 barrier.

Oil prices were inflated by the decision of OPEC+ group over the weekend to extend its existing agreement for output cut by 9.7 million bpd to end of July, but the sentiment was soured by announcement from Saudi Arabia that the kingdom and its Gulf allies UAE and Kuwait will halt additional voluntary cuts that three countries were doing last month.

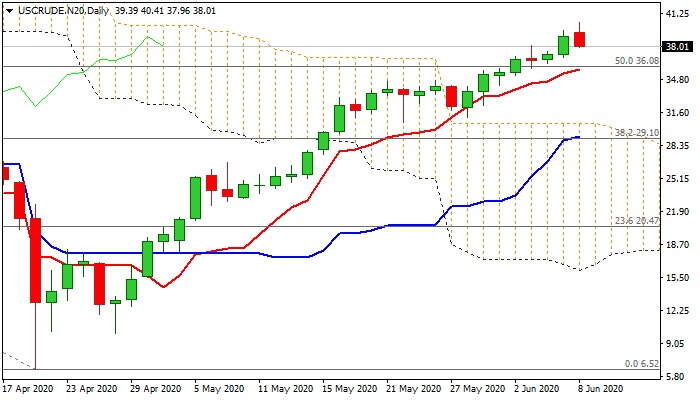

Today’s dip so far looks like correction and positioning for renewed attack at $40 level, with solid supports at $36.08 (broken 50% retracement of $65.63/$6.52) and $35.77 (rising daily Tenkan-sen) expected to hold and offer opportunities to re-enter larger uptrend.

Caution on break of these supports as this would signal deeper correction and expose supports at $33.28 (rising 20DMA) and $31.12 (28 May trough).

Res: 39.64; 40.00; 40.41; 41.04

Sup: 37.59; 37.01; 36.08; 35.77