Bear-trap adds to negative signals after dovish Powell deflated dollar

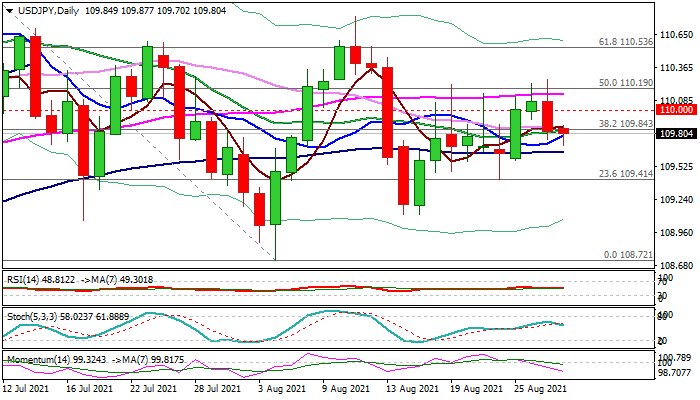

The USDJPY stands at the back foot in early Monday, following double upside rejection above 55 DMA and Friday’s big bearish candle with long upper shadow.

Bull trap above the cloud adds to negative signals after dovish comments from Fed chief Powell at the end of Jackson Hole symposium depressed dollar.

Daily MA’s remain in mixed mode with the price action ranging between 100DMA (109.64) and 55DMA (110.13) but rising bearish momentum keeps the downside at risk.

Clear break of 100 DMA would open way towards last week’s low (109.41) and more significant Aug 16-17 double-bottom at 109.11.

Psychological 110 barrier and 55DMA proved to be strong resistances and expected to continue to limit the upside and maintain bearish near-term bias.

Res: 110.00; 110.13; 110.26; 110.45

Sup: 109.64; 109.41; 109.11; 108.87