Bear-trap underpins but the action remains capped by 100DMA

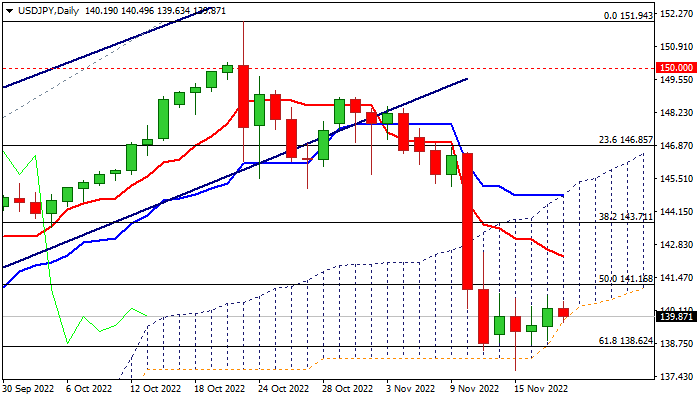

The USDJPY is holding in extended directionless mode, consolidating around 140 handle after last week’s heavy losses (the pair was down 5.7% for the week).

Sharp fall found firm ground at 138.62/14 zone (base of ascending thick daily cloud / Fibo 61.8% of 130.39/151.94 upleg).

Failure to register close below these levels generated initial signal of a bear trap, which would offer stronger support if the action managed to break above current range, capped by 100DMA (140.95).

Also, rising cloud base continues to contain and underpin the action, providing solid support and so far keeping the downside protected.

However, daily studies remain in bearish mode that keeps the downside vulnerable, especially while the action stays capped by 100DMA, keeping in play risk for renewed attack at pivotal supports (138.62/14) clear break of which would signal bearish continuation and expose target at 135.47 (Fibo 76.4%).

Alternative scenario sees sustained break of 100DMA as initial bullish signal for stronger recovery, though bulls would require more evidence (lift through 10DMA at 141.73 and daily Tenkan-sen at 142.30) for confirmation.

Res: 140.95; 141.16; 141.72; 142.30

Sup: 139.70; 138.62; 137.67; 135.81