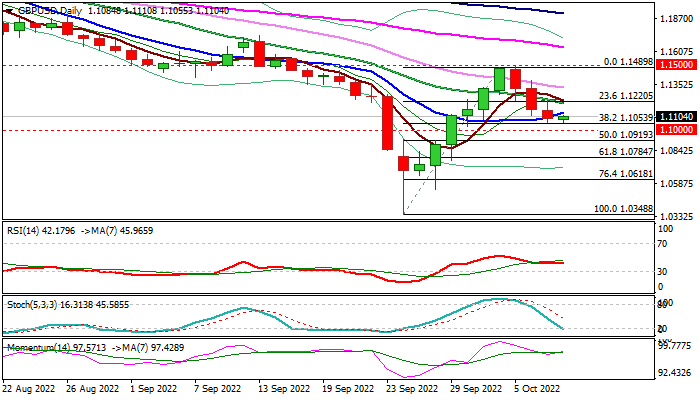

Bears are taking a breather above Fibo support at 1.1053

Cable starts the week in a quiet mode and holding within a narrow range above 1.1053 (Fibo 38.2% of 1.0348/1.1489 upleg / last Friday’s low) where the strong fall in past three days found temporary footstep.

Near-term structure was weakened on quick pullback after a double upside rejection at 1.1500 zone, as the pair was down 3.3 on Wed/Fri drop.

Solid US labor data last Friday added to expectations for another Fed’s big rate increase next month, contributing to weak near-term sentiment.

Daily studies show moving averages in bearish setup and strong negative momentum, although oversold stochastic is slowing bears for now.

Upticks should stay capped by falling 20DMA (1.1208) to keep near-term bears off 1.1500 zone in play, however, clear break of 1.1053 Fibo level and psychological 1.10 support is needed to signal bearish continuation and expose target at 1.0784 (Fibo 61.8% of 1.0348/1.1489).

Res: 1.1137; 1.1208; 1.1327; 1.1383

Sup: 1.1053; 1.1000; 1.0919; 1.0784