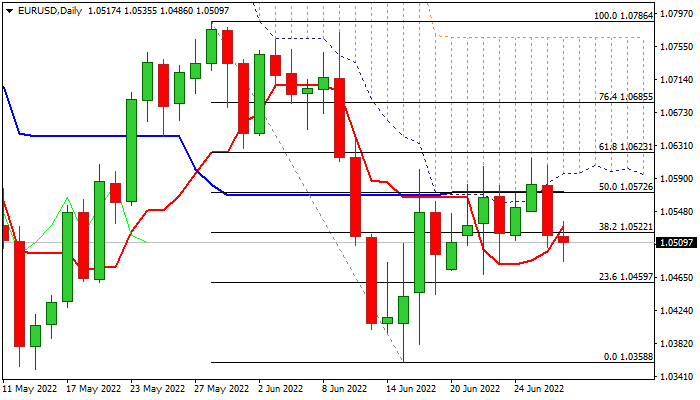

Bears start to regain control after repeated upside rejections but still need a confirmation

Repeated failure at the base of a daily cloud and subsequent drop on Tuesday (0.6%) that registered a marginal close below 10DMA (1.0537) generated initial signal of recovery stall, though the action on Wednesday is again without direction.

Fresh bears were partially offset by mixed, but with prevailing optimism EU member countries data that kept the single currency afloat for now, though the downside is expected to remain at risk if the pair makes another daily close below 10DMA.

The Euro is additionally weighed by increased month-end demand for dollar, while negative daily studies add to bearishly aligned near-term outlook.

Repeated close below 10DMA would require extension and close below 1.0486 (50% retracement of 1.0358/1.0614) to confirm negative signal and open way for further easing.

Conversely, bounce above 10DMA would ease immediate downside risk, however the action is to remain directionless while below 1.0596 (the base of narrowing daily cloud.

Res: 1.0537; 1.0554; 1.0565; 1.0596

Sup: 1.0486; 1.0456; 1.0419; 1.0358