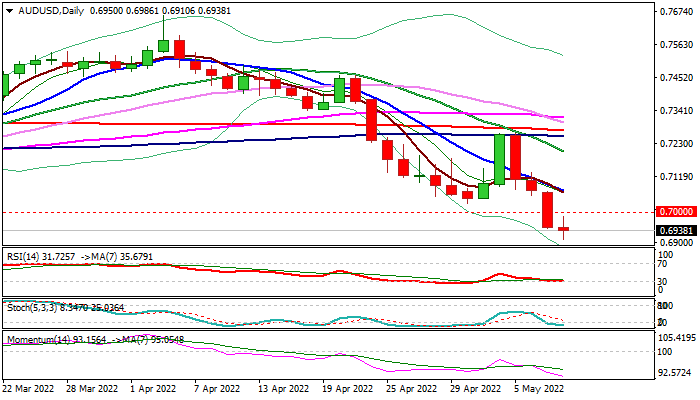

Bears to stay intact while upticks are limited under strong barriers at 0.7000/29

The AUDUSD edges higher from new 22-month low (0.6910) on Tuesday, as US dollar bulls lose pace and traders partially take profit after pair’s 4.2% loss in past three days.

Overall picture remains bearish, as larger downtrend from 2022 peak at 0.7661 made a textbook correction (0.7029/0.7265) capped by 100DMA and near Fibo 38.2% of 0.7661/0.7029 downleg, before resuming.

Break and weekly close below psychological 0.70 support added to negative signals from daily indicators, as 14-d momentum continues to trend lower deep in the negative territory and south-heading daily moving averages formed a number of bear-crosses, weighing on the Aussie.

Ideal scenario sees limited upticks by 0.7000 (reverted to resistance) and 0.7029 (previous low) to offer better selling opportunities for extension through 0.6910 (new 22-month low) towards the top of thick monthly cloud (0.6822).

Traders await Wednesday’s release of inflation data for April from China (1.8% y/y f/c vs 1.5% Mar) and the US (8.1% y/y f/c vs 8.5% Mar) which will provide fresh signals.

Res: 0.6986; 0.7000; 0.7029; 0.7075

Sup: 0.6910; 0.6877; 0.6822; 0.6758