Bitcoin hits new 2022 low, outlook remains negative on expectations of aggressive Fed

The Bitcoin hit new 2022 on Monday, extending a steep fall into fifth straight day.

Last week action closed with over 9% loss and generated additional negative signal on completion of weekly bearish engulfing pattern.

Expectations for another large Fed rate hike (0.75% is widely expected, though some economists bet for 1% raise) keeps bitcoin under increased pressure.

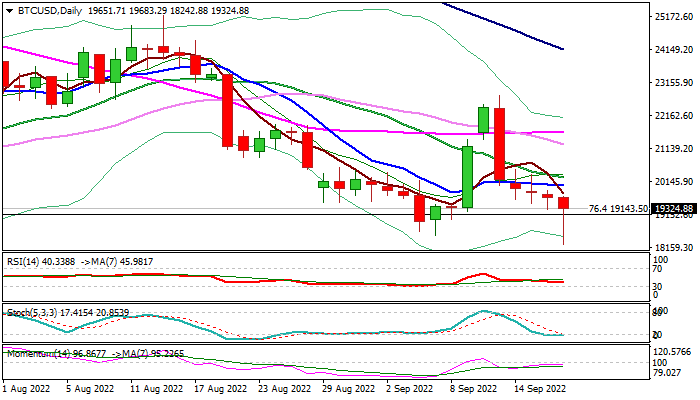

Today’s dip to new annual low (18242) was so far short-lived as the price bounced, but upticks were limited, as overall structure is bearish and sentiment is negative.

Monthly chart shows that that larger bears off a record high at 68911 (Nov 2021) struggle at pivotal Fibo support at 19143 (76.4% of 3770/68911, Mar 2020/Nov 2021 rally), lacking a clear break lower for the fourth consecutive month.

Eventual clear break here and also through the base that was forming in past 3 ½ months at 18500 zone, would signal a continuation of a larger downtrend and unmask targets at 13207 (Nov 2021 low); 12270 (100MMA) and open way for test of psychological 10000 support on stronger acceleration.

Technical studies are in bearish setup, with fresh negative signal seen on formation of 20/200WMA death-cross.

Falling daily Tenkan-sen (20508) should keep the upside protected, to maintain negative bias.

Res: 19790; 20025; 20280; 20508

Sup: 19143; 18512; 18242; 17540