BRENT OIL extends rally on strike threats in Norway

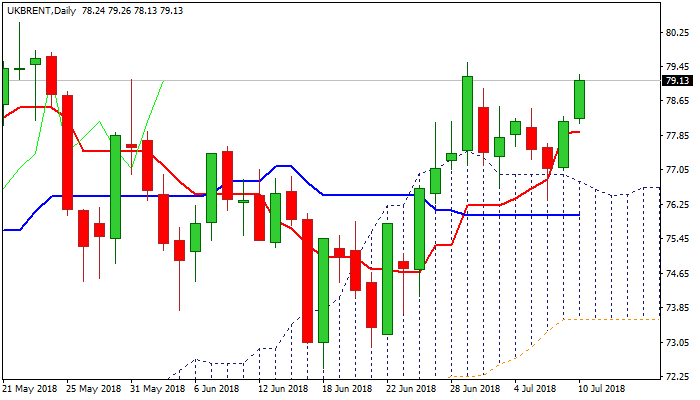

Brent oil rallies strongly for the second day and is on track to fully retrace corrective phase from $79.54 (29 June high) to $76.35 (06 July low) which was contained by top of thick daily cloud.

Fresh boost to oil prices comes from threats of strike of oil workers in Norway.

Oil prices were boosted by strong fall in US oil inventories last week; OPEC’s decision to increase output and concerns about the impact of sanctions on Iran.

Fresh bullish acceleration pressures initial barrier at $79.54, eyeing psychological $80 level and key resistances at $80.48 (17/22 May peaks), the highest since mid-November 2014).

Regain of $80.48 pivot would signal continuation of larger uptrend from $27.09 (January 2016 low) and would unmask next pivotal barrier at $81.84 (Fibo 61.8% of $115.68/$27.09, 2014/2016 fall).

Bullish daily techs support scenario, with focus turning towards releases of US crude stocks reports (API report is due today and EIA will release its weekly report on Wednesday).

Rising 10SMA offers solid support at $77.91 which is expected to keep the downside protected.

Res: 79.54; 80.00; 80.48; 81.00

Sup: 78.13; 77.91; 77.03; 76.49