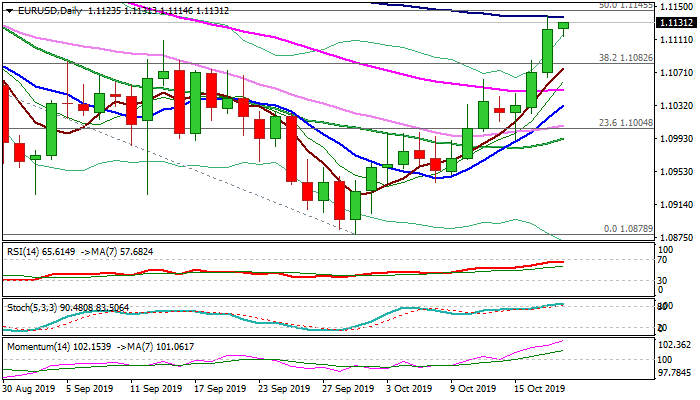

Bullish outlook above daily cloud exposes 200DMA target

The Euro remains well supported and consolidating above daily cloud after Thursday’s break above the cloud (the first in three months) generated bullish signal.

Bulls consolidate within narrow range and prepare for push through 100DMA (1.1137) which capped larger advance on Thursday.

Sentiment remains positive and the action underpinned by strong bullish momentum daily chart that keeps near-term focus at the upside.

Eventual break above 100DMA would open way towards strong barriers at 1.1208 (200DMA / Fibo 61.8% of 1.1412/1.0878 bear-leg).

The pair is expected to benefit from any outcome of the end of Brexit story that adds to positive outlook.

Broken daily cloud top (1.1111) offers immediate support, with extended dips expected to find support at 1.1082 (broken Fibo 38.2%) to keep bulls intact.

Res: 1.1137; 1.1145; 1.1163; 1.1208

Sup: 1.1111; 1.1082; 1.1065; 1.1048