Bulls continue to face strong headwinds but remain in play for now

Cable edged lower in European trading on Friday but remains resilient as less steep than expected fall in UK GDP partially compensates negative impact from lockdowns on raging coronavirus and Brexit.

Bulls probed again through 1.37 and posted marginally higher 2021 peak at 1.3711 on Thursday, after dovish remarks from Fed chief Powell who said that the US is still far from its inflation and labor goals and the central bank is going to continue using monetary policy tools until the situation improves.

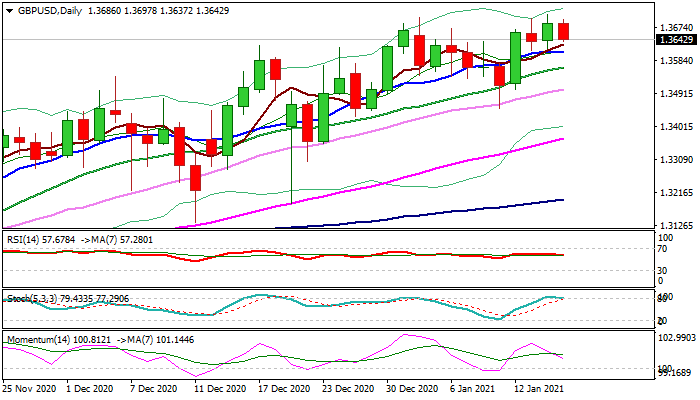

Failure to register a daily close above 1.37 mark confirms that bulls continue to face very strong headwinds that keeps possibility of stall in play, with congestion under 1.37 zone extending for the third consecutive week.

Negative signals are developing on daily chart as bullish momentum is rapidly fading and stochastic is reversing from overbought zone, but moving averages are still in full bullish setup and counteract.

Sideways-moving 10DMA (1.3609) offers initial support, close below which would soften near-term tone and expose pivots at 1.3563 (rising 20DMA) and 1.3502 (30DMA), with break of the latter to generate initial signal of double-top and reversal.

Res: 1.3697; 1.3711; 1.3763; 1.3800

Sup: 1.3609; 1.3563; 1.3502; 1.3451