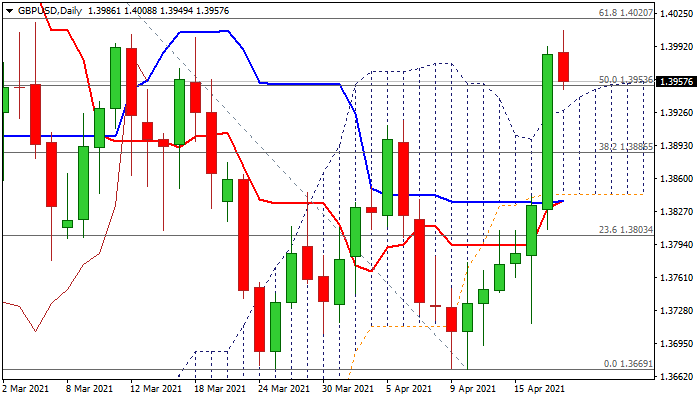

Cable retreats after bulls failed to clearly break 1.40 barrier

Cable pulls back from new 6-week high, posted after brief probe through psychological 1.40 barrier, where bulls faced strong headwinds.

Profit-taking after Monday’s 1.1% advance (the biggest one-day rally since Oct 21) and overbought daily studies pushed the price lower.

Current easing s far looks like positioning for final push through pivotal barriers at 1.4000/20 (psychological / Fibo 61.8% of 1.4238/1.3669), as bulls take a breather after six-day rally which strongly accelerated on Monday.

Solid supports at 1.3941 (daily cloud top) and 1.3918 (Apr 6 former high) should ideally contain dips and guard pivot at 1.3879 (Fibo 38.2% of 1.3669/1.4008) loss of which would sideline bulls and allow for deeper correction.

Fundamentals were also not working in favor of sterling on Tuesday as data pointed to unstable state of the UK labor market after company payrolls fell by 56K in March (the first decline in four months).

Traders turn their focus on Wednesday’s release of UK inflation data, as CPI is expected to rise by 0.8% in March, doubling February’s 0.4% rise.

Better than expected March figures would give fresh boost to British pound for 1.41+ advance.

Res: 1.4000; 1.4020; 1.4050; 1.4103

Sup: 1.3941; 1.3918; 1.3879; 1.3856