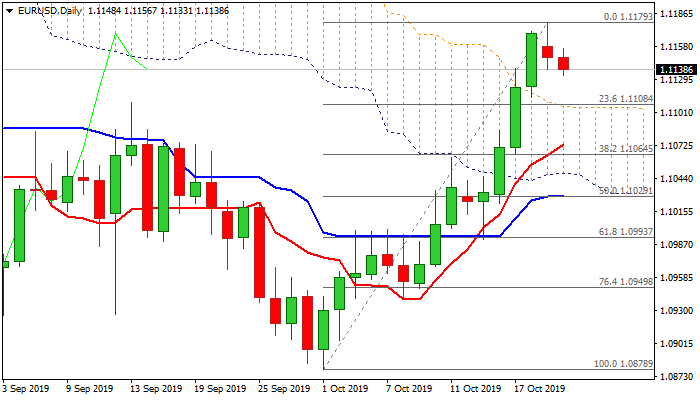

Correction may precede fresh upside; good bids at 1.11 and 1.1070 zone

The Euro stands at the back foot in Europe on Tuesday as Monday’s close in red (the first bearish close after four days of strong rally) which also left daily candle with long upper shadow, signal that bulls might be running out of steam.

Broken 100DMA (1.1135) now acts as support and keeps the downside protected for now, but deeper pullback cannot be ruled out as daily stochastic is overbought and bullish momentum is fading.

Daily cloud top (1.1105) should ideally contain and mark current action as positioning for fresh advance, as recent breaks above daily cloud and 100DMA were bullish signals.

Near-term bulls off 1.0878 (1 Oct low) eye targets at 1.1206/08 (200DMA / Fibo 61.8% of 1.1412/1.0878), violation of which would generate strong bullish signal.

Dip below daily cloud top would delay advance but bullish bias is expected to remain in play if extended dips find footstep at next significant supports at 1.1070 zone (daily Tenkan-sen / Fibo 38.2% of 1.0878/1.1179 ascend).

Res: 1.1156; 1.1179; 1.1208; 1.1230

Sup: 1.1133; 1.1114; 1.1105; 1.1064