Dollar bulls are losing traction; US NFP could spark deeper pullback

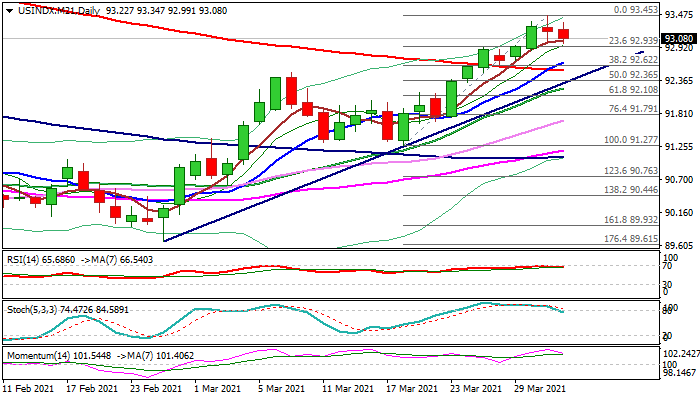

The dollar extends consolidation into second day as bulls take a breather under new five-month high (93.45).

Lower volumes in pre-holiday trading and higher than expected US jobless claims, could cause deeper drop, as reversal pattern is forming on daily chart.

Investors focus on US March non-farm payrolls data, which could have a negative impact on the dollar whatever the outcome will be.

The NFP is forecasted strong at 647K compared to previous month’s 379K, with increased pressure on the greenback expected on weaker than expected result, but possibility of ‘buy rumor / sell facts’ scenario in case the results meet or even exceed expectations, exists and could push dollar lower after 2.5% advance in March (the biggest monthly rally since July 2019).

Daily studies support the notion as stochastic is heading south after diverging from the price action and emerging from overbought territory, while bullish momentum is fading.

Loss of initial support at 92.93 (Fibo 23.6% of 91.27/93.45 upleg) would increase risk of an extension towards key supports at 93.62/42 zone (Fibo 38.2% / 200DMA / bull-trendline connecting 89.66 and 91.27 lows).

Res: 93.34; 93.45; 93.75; 93.90

Sup: 92.93; 92.70; 92.62; 92.52