Dollar continues to benefit from risk aversion but the outlook for Fed’s next steps is highly uncertain

The dollar index remains firm and posted new marginally higher high on Wednesday (97.82, the highest since May 2020) remaining strongly supported by rising uncertainty, as fights in Ukraine extend into seventh day, with no signs of easing and followed by contradicting news, fueling existing risks in global markets.

Also, skyrocketing energy prices, on growing fears that sanctions on Russia would significantly disrupt global energy supply, make investors very cautious.

Fed Chair Jerome Powell, in his remarks to Congress, said the US central bank is now in more difficult position, as sanctions on Russia would slower global economic growth and increase financial stress, but signaled it is still not time to panic.

Such conditions are far from supportive for the Fed’s earlier decision to start tightening its monetary policy as early as March, with strong rise of energy prices being the key component in undermining Fed’s attempts to establish the trend in lifting interest rates and counter raging inflation.

The Fed will join the other global central banks which face the same dilemma in assessing the degree to which the war in Ukraine will damage growth, raise prices and how that might affect their monetary policies.

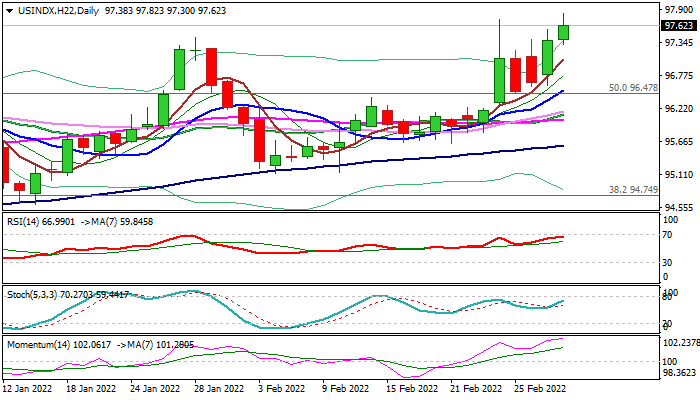

Res: 97.82; 98.20; 99.31; 100.00

Sup: 97.30; 96.61; 96.47; 96.15