Dollar dips on lower than expected US Nov inflation

The dollar index was sharply lower on Tuesday (down 1% since release of US CPI data) as lower than expected inflation figures in November boost optimism of further drop in consumer prices and open way for the Fed to start easing its aggressive monetary policy tightening, employed to bring soaring inflation, which hit the highest since December 1981, under control.

The US central bank is widely expected to raise its policy rate by 50 basis points at its two-day December policy meeting which concludes on Wednesday, following a series of four consecutive jumbo hikes by 75 basis points,

Slower pace in raising interest rates would signaling an end of the phase of aggressive rate hikes in past few months, as inflation started to recede and the central bank wants to assess the impact of the measures on inflation, as well as on the economy.

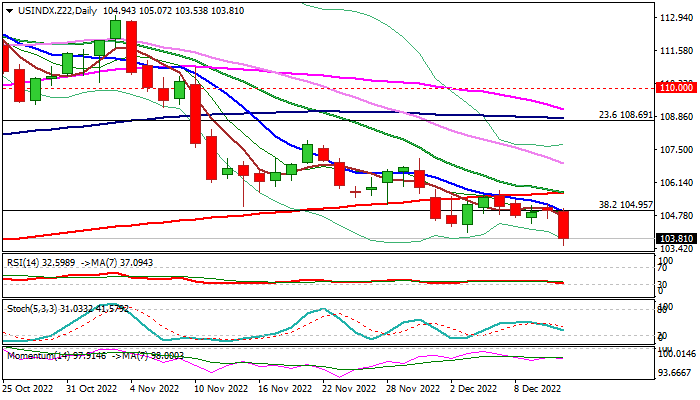

Fresh weakness generates initial signal of bearish continuation after larger downtrend paused last week.

Bears remain fully in play on daily chart, with additional negative signal expected from converged 20/200DMA’s, on track to complete a death-cross pattern.

All eyes are on Fed, expecting the central bank to confirm easier approach to the monetary policy in coming meetings (as tomorrow’s 50 bp hike has been already priced in) that would add to dollar’s negative stance and open way for further weakness, exposing targets at 101.68 (top of rising weekly cloud) and 101.29 (May 29 trough).

Broken Fibo 38.2% of 89.15/104.72 at 104.95, reinforced by falling 10DMA, offers solid resistance and guards more significant 200DMA (105.70).

Res: 104.95; 105.39; 105.70; 106.12

Sup: 103.53; 103.22; 101.68; 101.29