Dollar slips to one-month low vs yen as stimulus optimism boosts risk appetite

The pair fell to one-month low on Wednesday, on track for the biggest daily loss since 28 Aug as growing optimism over US stimulus talks boosts risk appetite and further deflates the dollar.

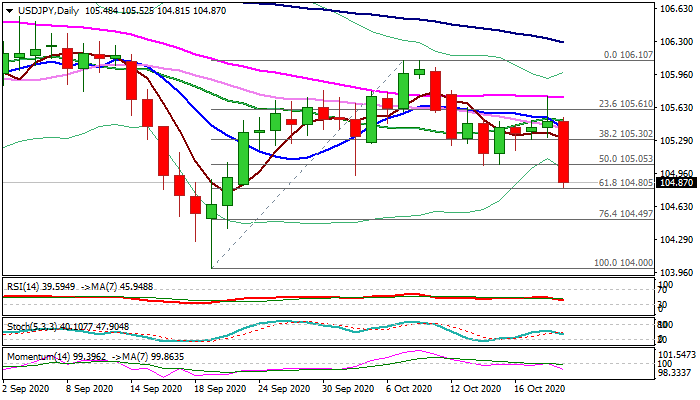

Fresh bearish acceleration surged through pivotal supports at 105.00/05 zone (round-figure / 14/15 Oct lows) and cracked important technical support at 104.80 (Fibo 61.8% of 104.00/106.10 rally).

The action also completed a Head and Shoulders pattern on daily chart, adding to negative signals.

Firm break of 104.80 level would expose next target at 104.50 (Fibo 76.4%) and risk acceleration towards key support at 104.00 (21 Sep low).

Rising negative momentum and daily MA’s in full bearish configuration, support the action.

Res: 105.05; 105.30; 105.49; 105.61

Sup: 104.80; 104.50; 104.39; 104.00