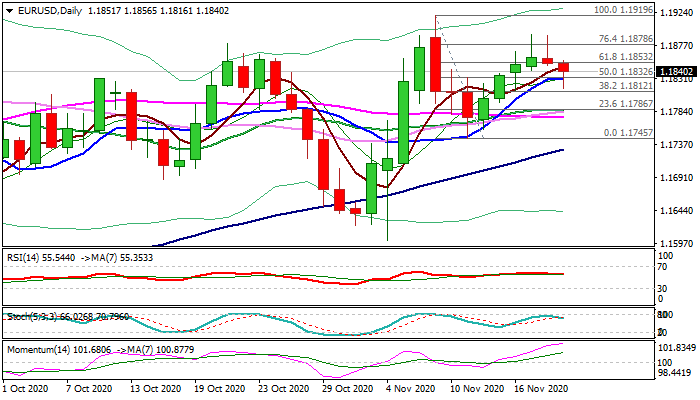

Double upside rejection and soured risk sentiment shift near-term focus lower

The Euro dipped to three-day low on Thursday, seeing increased risk of deeper pullback after bulls showed strong signals of stall by leaving two consecutive inverted hammer candles (Tue/Wed).

Daily RSI turned south, warning of loss of momentum and fresh weakness cracked 10DMA (1.1831).

Fresh bears faced headwinds from strong support provided by daily cloud top that temporarily stopped fall, but fundamentals work against the Euro as risk sentiment fades on raging coronavirus and new restrictions and signals that the ECB may further ease policy in December as inflation expectations are falling again.

Bears look foe initial signal on close below 10DMA, with penetration of daily cloud (spanned between 1.1811 and 1.1762) to further weaken near-term structure.

The pair may hold in extended consolidation if failing to clear 10DMA, but near-term bias is expected to remain negative as long the action stays below cracked Fibo barrier at 1.1878 (76.4% of 1.1919/1.1745 bear-leg).

Res: 1.1856; 1.1878; 1.1893; 1.1919

Sup: 1.1831; 1.1811; 1.1796; 1.1784