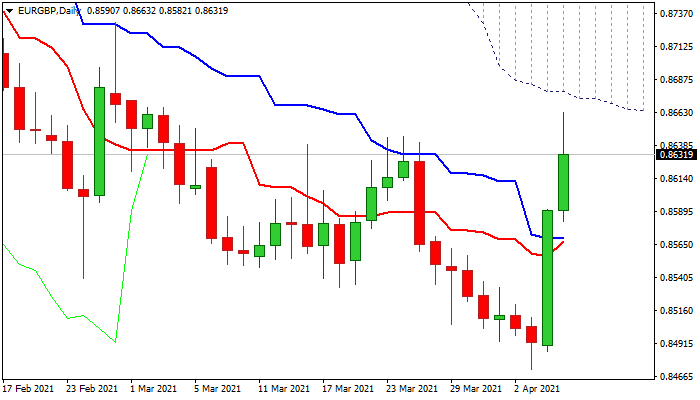

EURGBP rose to one-month high but thick falling daily cloud weighs

The cross is in strong rally for the second day and hit one-month high (0.8663) after over 2% advance in two days.

The Euro remains boosted by strong economic data while sterling came under increased pressure on concerns about the Astra Zeneca vaccine as Britain’s medicine regulator decided to halt vaccine for the people under 30s and weaker than expected UK services / composite PMI’s further soured the sentiment.

Oversold weekly and monthly studies contributed to profit-taking that stalled the downtrend from December’s peak at 0.9229.

Also, formation of bear-trap under pivotal Fibo support at 0.8515 (38.2% of 0.6924/0.9498 rally) boosts recovery.

Fresh bullish acceleration cracked pivotal resistances at 0.8645 (Mar 23 high) and 0.8664 (falling 55DMA), but faced headwinds here, as falling thick daily cloud (spanned between 0.8673 and 0.8878) weighs that would likely result in consolidation.

Dips should be ideally contained by converging daily Tenkan-sen / Kijun-sen (0.8567/69) to offer better buying opportunities and keep bulls intact.

Res: 0.8664; 0.8673; 0.8700; 0.8730

Sup: 0.8600; 0.8682; 0.8567; 0.8542