Euro extends through another key support after downbeat EU data and persisting strong demand for dollar

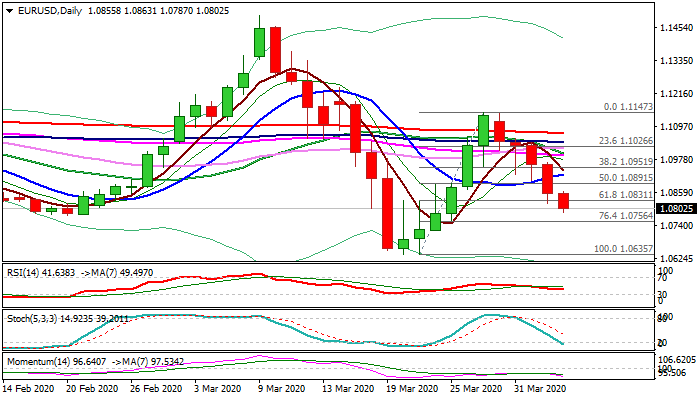

The Euro broke pivotal Fibo support at 1.0831 and probes below 1.08 handle on Friday as steep fall extends into fifth straight day.

Fading risk sentiment after disastrous jobless claims data and strong demand for safe-haven dollar and yen keep the single currency under pressure.

Thursday’s close below daily cloud base, reinforced by 50% of 1.0635/1.1147, was strong bearish signal which would be boosted if today’s action closes below 1.0831 (Fibo 61.8%) that would accelerate bears and risk drop towards three-year low at 1.0635.

Negative fundamentals add to strong bearish outlook as EU Services and Composite PMI’s fell to record lows (Services Mar 26.4 from 52.6 in Feb / Composite Mar 29.7 from 51.6).

US Non-Farm payrolls are forecasted for 100K drop in March from 273K rise previous month but could fall much more as jobless claims data signaled the depth of negative impact of coronavirus pandemic on the US economy that would increase demand for dollar and further depress the Euro.

Res: 1.0831; 1.0863; 1.0891; 1.0925

Sup: 1.0787; 1.0756; 1.0700; 1.0635