Euro hits multi-month high on probe above 200DMA, but correction likely to precede further advance

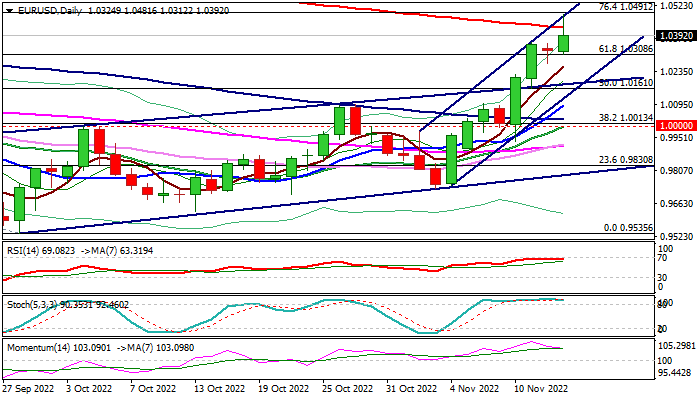

The Euro resumed its steep uptrend after bulls took a brief breather on Monday and cracked 200DMA (1.0428), hitting the highest in 4 ½ months.

Fresh advance peaked at 1.0481, just ahead of barriers at 1.0491 /1.0500 (Fibo 76.4% of 1.0786/0.9535 bear-leg / psychological).

Subsequent easing below 200DMA warn that bulls face strong headwinds at pivotal resistance zone, as daily studies are overbought and strong bullish momentum is easing, though the action is still lacking firmer signal of pullback as stochastic is ranging deeply in the overbought territory and RSI is moving around the overbought borderline.

Broken Fibo 61.8% (1.0308) offers initial and solid support, with extended dips expected to find ground above broken upper borderline of bull-channel (1.0197) to keep bulls in play.

Sustained break above 200DMA would generate initial bullish signal which would look for confirmation on lift above pivotal 1.0500 zone and open way towards targets at 1.0786 / 1.0844 (May 30 peak / base of falling weekly cloud).

Res: 1.0428; 1.0491; 1.0550; 1.0614

Sup: 1.0364; 1.0308; 1.0259; 1.0197