Euro remains under strong pressure and may accelerate lower if US jobs data beat forecast

The Euro extends weakness into fifth straight day, hitting the lowest in nearly three months on Friday.

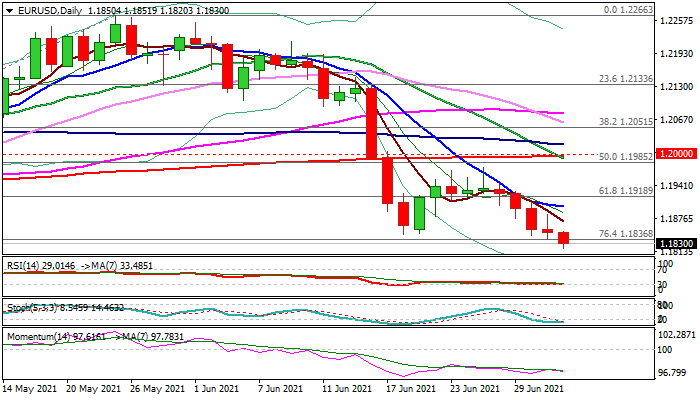

Bears broke below key supports at 1.1747/36 (June 18/21 lows / Fibo 76.4% of 1.1704/1.2266 ascend) but need to register weekly close below to confirm bearish signal.

The pair is on track for weekly close in red with additional negative signal seen on penetration of ascending thick weekly cloud.

Near-term action eyes initial targets at 1.1800/1.1795 (round-figure / Apr 6 low) with stronger bearish acceleration to risk test of key support at 1.1704 (2021 low / higher low of larger uptrend from 2020 low at 1.0635).

Traders eye US jobs report which could further lift dollar on stronger than expected June figures.

Thursday’s spike high (1.1884) and falling daily Tenkan-sen (1.1897) mark solid resistances which need to hold and keep bears intact.

Only violation of key barriers at 1.1895 (base of thick daily cloud) and 1.20 (psychological) would sideline bears and shift near-term focus higher.

Res: 1.1851; 1.1884; 1.1897; 1.1918

Sup: 1.1795; 1.1737; 1.1704; 1.1685