EURUSD may accelerate towards 1.20 barrier if US jobs data disappoint

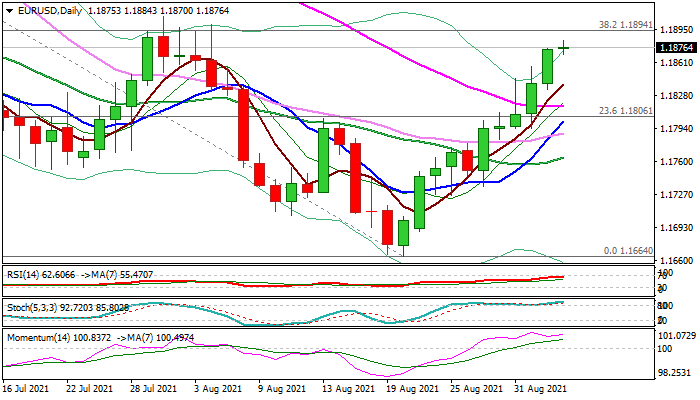

The Euro keeps firm bullish tone and approaching strong barriers at 1.1900 zone (Fibo 38.2% of 1.2266/1.1664 at 1.1894 and July 30 peak at 1.1908).

Break here would confirm reversal and unmask key 1.20 resistance (psychological / 200DMA / daily cloud top).

The pair is on track for the second consecutive weekly advance that adds to positive signals.

Daily techs show rising bullish momentum and MA’s (5;10;20;30;55) multiple bull-crosses that underpin the action.

US non-farm payrolls data are key event on Friday and expected to provide stronger direction signals.

Economists expect non-farm payrolls to maintain positive trend and to rise by 750K in August after the economy added nearly two million new jobs in the past two months, but soaring coronavirus cases, downgraded estimations for Q3 GDP and persisting supply shortages may sour the sentiment and slow employment growth.

Most of analysts expect the August figure to come around or slightly above forecast that would be overall positive, but the negative surprise cannot be ruled out, due to abovementioned factors and downbeat figures from the US private sector, released earlier this week.

The pair is expected to maintain bullish bias while daily cloud base (1.1842, now reverted to solid support) holds, although bulls may face strong headwinds from 1.1900 resistance zone.

Alternatively, return and close below thick daily cloud, would hurt bulls and generate initial signal of recovery stall.

Res: 1.1894; 1.1908; 1.1954; 1.2000

Sup: 1.1870; 1.1842; 1.1816; 1.1801