Fresh speculations that Fed may opt for 1% rate hike lift dollar

The USDJPY accelerated higher in Asia / early Europe on Thursday, gaining over 1% and hitting new 24-year high, lifted by expectations for another big rate hike by Fed, as well as increased safe-haven demand on growing fears of a recession.

Stronger than expected US inflation figures for June, released on Wednesday, showed inflation hit new highest level in four decades and added to bets for another big hike from the Fed.

Wide expectations for another 0.75% hike in July policy meeting later this month, have been boosted by fresh speculations that the US central bank may opt for even more aggressive approach and raise interest rate by 1%, as skyrocketing inflation is likely to rise further and harm the economy more.

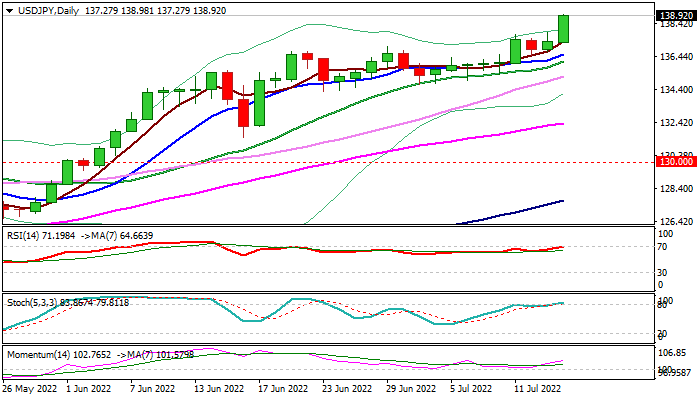

Bullish technical studies on daily chart add to positive outlook, with bulls looking for a break of round-figure 139.00 barrier that would open way towards targets at 139.92/140.00 (Sep 1998 high / psychological).

Headwinds on approach to these levels can be expected as studies are overbought, with dips to offer better buying opportunities.

Rising 10/20DMA’s offer solid supports (currently at 136.52/136.10) which should keep the downside protected.

Res: 139.26; 139.92; 140.00; 141.00

Sup: 138.02; 137.75; 137.27; 136.52