Gold regains traction but near-term direction will depend on signals of Fed’s next steps

Gold jumped nearly 1% on Tuesday, fully reversing Monday’s drop, sparked by hawkish comments from Fed officials on interest rate hikes.

The dollar lost traction quickly after news, providing fresh support for the metal, though gains are still fragile as traders await Wednesday’s speech of Fed Chair Powell, to get more clues about the central bank’s next steps.

If Powell indicates that the end of rate hike cycle is close, gold would receive strong boost, while the metal’s price would come under fresh pressure on signs that Fed remains on course for further policy tightening, but the pace of future rate hikes would also play important role.

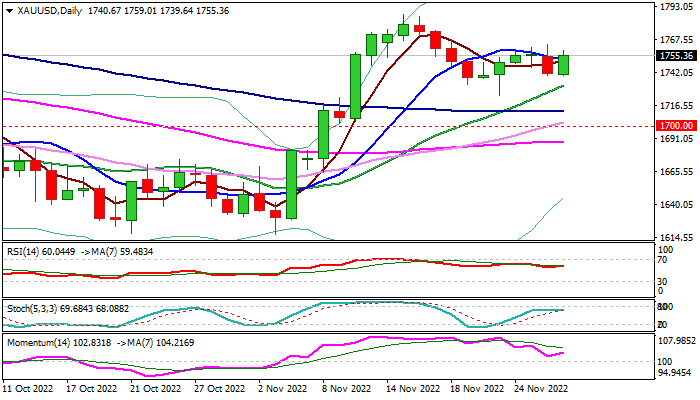

Near-term structure remains positive as daily moving averages are in bullish setup and positive momentum is rising, though the action needs to clear pivotal barriers at $1762/63 (Fibo 61.8% of $1786/$1723 Monday’s high) to signal a higher low ($1723) and shift near-term focus towards key barriers at $1786/$1800 (Nov 15 high / 200DMA / psychological).

Conversely, loss of temporary higher base at $1739 would weaken near-term structure and expose key supports at $1723/21 (Nov 23 spike low / Fibo 38.2% of $1616$1786 rally).

Res: 1763; 1771; 1786; 1800

Sup: 1746; 1739; 1731; 1721