Larger bears are on hold, awaiting stronger signals from Jackson Hole meeting

Spot gold price edges higher from new low at $1727 (the lowest since July 27) after disappointing US data on Tuesday temporarily deflated dollar, giving gold bears an opportunity to consolidate.

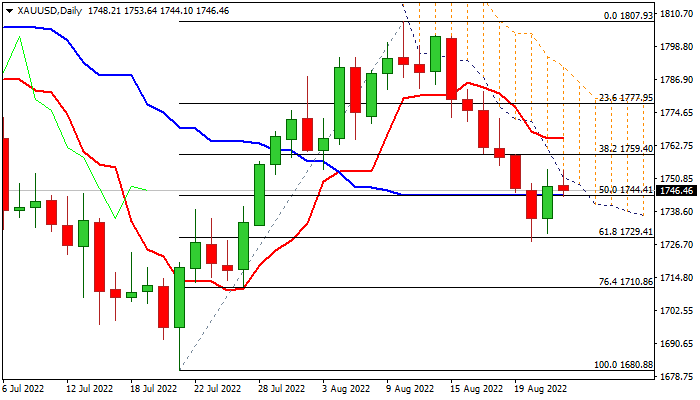

Tuesday’s bullish daily close (the first in seven days) completed bullish engulfing pattern on daily chart generating initial bullish signal, but fresh bulls so far lack strength for stronger recovery and remain capped by the base of falling thick daily Ichimoku cloud.

This keeps short-term bearish structure (bear-leg from Aug 10) intact for now, with daily MA’s in bearish setup and rising negative momentum, adding to scenario of limited correction ahead of fresh push lower.

However, markets slowed the pace ahead of highly anticipated Jackson Hole symposium on Friday.

All eyes are on Fed Chair Jerome Powell, whose comments are expected to define near-term direction of the US dollar that will directly influence the performance of the yellow metal.

Powell has not much space to move in the situation when soaring inflation hurts and the central bank has already acted aggressively in tightening its monetary policy, in fight with surging consumer prices.

Powell may opt to remain on strongly hawkish path and decide to raise rates for another 75 basis points that would help in curbing inflation but will have negative impact on growth, in the situation when economy is at the edge of recession.

On the other hand, the Fed chief may announce slower pace of raising interest rates, according to economic conditions that would result in prolonged tightening cycle.

The first scenario is likely to be dollar-supportive that would put gold price under fresh pressure, while less hawkish approach to the monetary policy tightening would prompt investors out of dollar and underpin metal’s price.

Res: 1751; 1756; 1770; 1777

Sup: 1744; 1733; 1727; 1710