Near-term action slows, awaiting Fed minutes for fresh signals

Bears are taking a breather after a four-day drop from new multi-month high at $1786 stalled on weaker dollar, while traders collected some profits and stay on hold, awaiting late Wednesday’s release of the minutes of Fed’s last policy meeting for fresh signals.

The markets also slowed ahead of US Thanksgiving Day holiday, as volumes thinned, which points to likely scenario of range trading, but also risk of stronger spikes on possible news out of expectations.

Investors focus on Fed minutes for more signals about their steps in the near future after few super-sized rate hikes.

Many economists expect the US central bank to start downsizing rate hikes, to fine-tune its policy, in attempts to curb high inflation which started to show initial signs of easing, but also not to significantly harm economic growth.

Although that US policymakers signaled they are going to continue tightening the policy, slower pace in raising interest rates in next months would soften the ground under the dollar and offer fresh support to the yellow metal.

Alternative scenario, although less likely at the moment, in which the Fed will continue with 75 basis points hike in December, against widely expected 0.5% raise, would bring gold under fresh pressure.

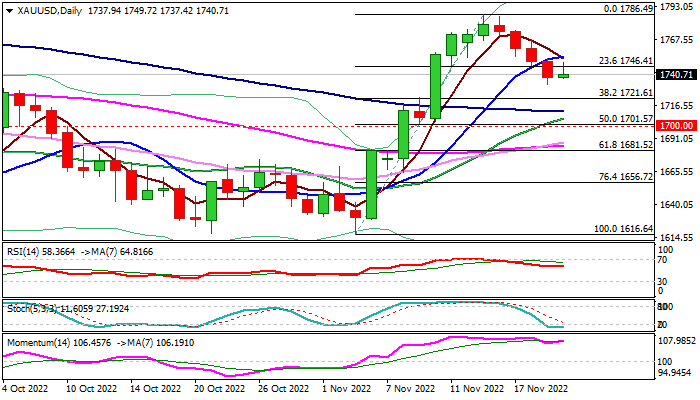

Res: 1746; 1754; 1767; 1786

Sup: 1732; 1721; 1711; 1705