New Zealand dollar jumps on disappointment from RBNZ rate decision but larger bears remain firmly in play

Kiwi dollar jumped around 1% against its US counterpart on Wednesday morning after RBNZ’s 50 basis points rate cut disappointed many who expected more aggressive action and cut by 75 basis points.

The Reserve Bank of New Zealand reduced interest rates to 4.25% from 4.75% and signaled further easing, as inflation fell near central bank’s target and the policymakers want to stimulate economy to accelerate the way out of recession.

RBNZ’s statement was dovish and signaled another 50 basis points cut in February, with expectations to reach levels between 2.5% and 3.5%, which is seen as neither restrictive nor accommodative, by the end of 2025.

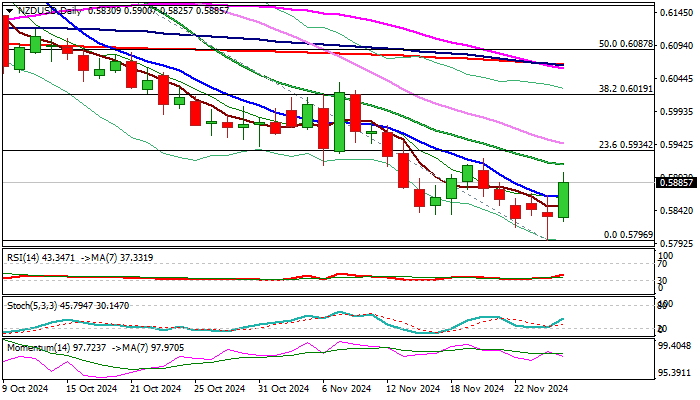

Although the disappointment from the central bank’s decision prompted some short covering, larger downtrend is unlikely to significantly hurt larger downtrend, as fundamentals are overall negative for Kiwi dollar and technical picture is bearish on daily and weekly chart.

Adding to negative signals was last week’s close below former base at 0.5850 (Apr / July).

Upticks face solid barriers at 0.5910/35 zone (lower top of Nov 20 / 20DMA / Fibo 23.6% of 0.6378/0.5796 downtrend) where recovery should be ideally capped to keep larger bears intact, while sustained break here would signal stronger correction.

Res: 0.5910; 0.5921; 0.5935; 0.5977

Sup: 0.5900; 0.5816; 0.5796; 0.5773