Oil price dips over 2% as rise in US oil rigs offsets positive impact from political turmoil in Venezuela

WTI oil holds in red on Monday and entering American session with over 2% loss.

The sentiment soured after data on Friday showed increase of US rigs for the first time this year (Baker Hughes oil rigs count 862 vs 852 previous week).

Political turmoil in Venezuela that signals potential disruption of oil exports from the country and higher oil prices in reaction, so far did not show impact on WTI performance on Monday.

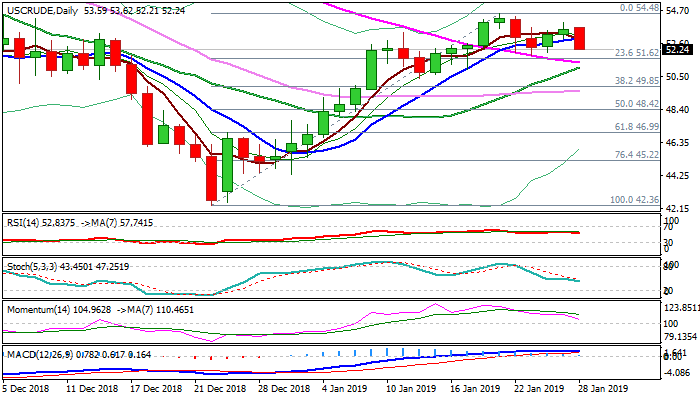

Oil price dipped to $52.42 on Monday after hitting $53.62 high on opening in Asia, probing below initial support at ($52.92) that exposes solid supports at $51.38/09 (converging 55/20SMA’s).

Technical studies on daily chart produce mixed signals, as converging 20/55SMA’s are on track to form bull-cross and underpin the action, but the price is sharply losing bullish momentum that signals negative impact.

Extension below 20/55 SMA’s would weaken near-term structure and expose pivotal supports at $50.67 (daily cloud base) and $50.00/$49.85 (psychological / Fibo 38.2% of $42.36/$54.48) with loss of the latter to generate reversal signal.

Near-term bulls are expected to remain in play while extended dips hold above daily cloud base.

Res: 52.92; 53.62; 53.91; 54.48

Sup: 52.06; 51.85; 51.38; 51.09