Oil prices rise further on brightening outlook, but traders will carefully watch results from US inflation report

WTI price rises further in European session on Thursday, in extension of 4% rally on Wednesday (the biggest one-day gain since Nov).

Improved sentiment on growing optimism about global demand following China’s economy reopening after the end of Covid restrictions, combined by expectations for a softer landing for the US economy, boosts oil prices.

All eyes are on today’s release of US Dec inflation report, with optimistic expectations for further ease in consumer prices that would likely result in Fed lowering the pace of rate hikes and offer additional support to oil prices.

However, traders remain cautious, fearing scenario of fresh rise in consumer prices which would signal that inflation is entrenched and probably more policy tightening will be needed to bring inflation under control that would sour the mood and put oil under pressure.

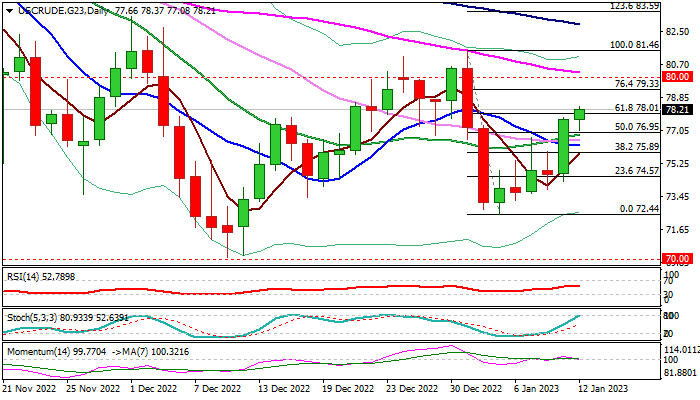

Daily chart shows bullishly aligned studies as DMA’s (10/20/30) turned to bullish setup, but fading positive momentum and stochastic about to enter overbought territory, warn that bulls may lose traction.

Recovery rally from $72.44 (Jan low) broke above Fibo 61.8% of $81.46/$72.44), with fresh bullish signal looking for confirmation on firm break here that would open way for extension towards targets at $79.23 (Fibo 76.4%) and $80.00 (psychological).

Daily Tenkan-sen offers solid support at $76.95 which should hold and keep bulls intact, while dip and close below daily Kijun-sen ($75.78) will be bearish.

Res: 78.37; 79.33; 80.00; 80.96

Sup: 78.01; 76.95; 75.78; 74.57