Recovery accelerates through key barriers on improved risk sentiment

The Euro accelerated higher on Tuesday (up 1% since Asian opening) boosted by improved risk sentiment that kept dollar under pressure for the second straight day.

Hawkish comments from ECB policymaker further fuel expectations for ECB’s 0.75% rate hike in October, adding to bullish near-term stance.

A number of key releases from the US this week to provide fresh direction signals on more evidence about the current conditions in the services and labor sector, after the data from US manufacturing sector fell below expectations.

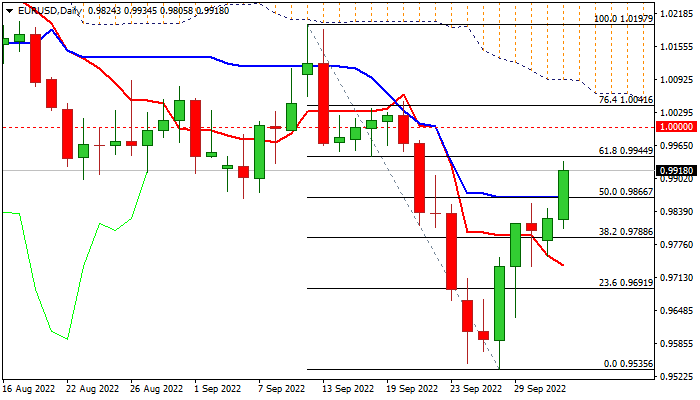

Improving daily technical studies (north-heading 14-d momentum / 5/10DMA bull cross) support the action, with additional positive signals from Monday’s close above pivot at 0.9788 (Fibo 38.2% of 1.0197/0.9535), formation of bullish engulfing pattern and today’s rise through 0.9866 (daily Kijun-sen / 50% retracement.

Bulls pressure Fibo 61.8% of 1.0197/0.9535 (0.9944), violation of which would open way for attack at parity level.

Overbought stochastic on daily chart warn of price adjustment, with dips to ideally stay above broken Kijun-sen to keep fresh bullish structure intact.

Res: 0.9944; 0.9975; 1.0000; 1.0041

Sup: 0.9866; 0.9844; 0.9788; 0.9735