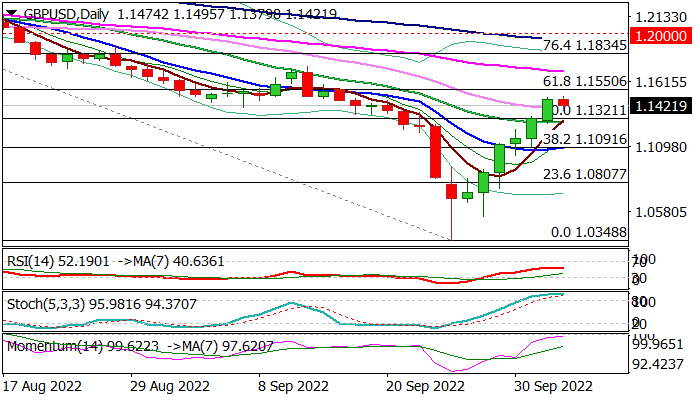

Bulls face headwinds at 1.15 zone, looking for fresh signals

Bulls are taking a breather under new highest since Sep 15 as recent rally faced headwinds on approach to 1.1500 barrier.

Fundamentals work in favor of pound, as U-turn in government’s plan to cut tax to the highest rate of income boosted the sentiment, while traders expect fresh signals from Fed, after the latest data showed signs of wobbling US economic growth that would prompt the central bank to reduce the pace of tightening, in the fight against high inflation.

The dollar will lose strong support in such scenario that would further boost pound’s near-term recovery.

Traders started to collect profits after six consecutive days of rally, on overbought conditions on daily chart and awaiting fresh signals.

Dips face initial support at 1.1285 (20DMA, reinforced by bull-cross with rising 5DMA), with extended pullback to find firm ground above 10 DMA (1.1090) and keep near-term bulls in play for fresh push towards pivotal barriers at 1.1500/50 (round-figure / Fibo 61.8% of 1.2293/1.0348 descend).

Recovery is also supported by long-tailed candles of last week and month which showed strong rejection after pound hit a record low vs dollar, however, the developments on fundamental front are expected to remain a key driver.

Res: 1.1500; 1.1550; 1.1590; 1.1738

Sup: 1.1379; 1.1321; 1.1285; 1.1225