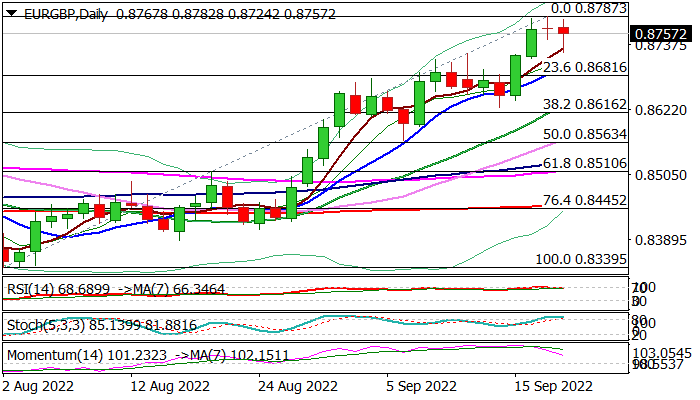

Reversal pattern is forming on daily chart

Daily chart shows initial signs of fatigue of the larger uptrend, as bullish momentum is fading and stochastic is reversing from overbought territory.

Also, evening Doji star pattern is forming on daily chart, which would, if completed, generate initial reversal signal.

The Euro was deflated on Tuesday by news regarding Ukrainian conflict and data that showed record EU’s current account deficit.

All eyes are on Fed’s policy meeting, which started today and the decision will be announced tomorrow, with prevailing expectations for 0.75% hike, but jumbo 1% increase is also in play, though with significantly lower percentage of support.

Fresh easing dented initial support at 0.8730 (rising 5DMA) but requires further verification on extension through 10DMA/ 200WMA (0.8701) and Fibo 23.6% of 0.8339/0.8787 (0.8681) to weaken near-term structure and open way for deeper pullback towards key supports at 0.8625/16 (Sep 14 through / Fibo 38.2%).

Res: 0.8787; 0.8800; 0.8850; 0.8880

Sup: 0.8724; 0.8701; 0.8681; 0.8625