Risk of pullback seen on solid US jobs data

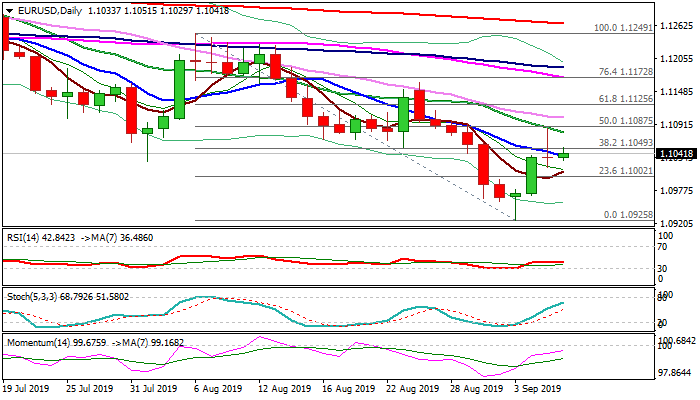

The Euro regains traction and attacks again pivotal Fibo barrier at 1.1049 (38.2% of 1.1249/1.0925 descend after bulls were strongly rejected at falling 20DMA (1.1085).

Thursday’s action ended in Doji with long upper shadow, following bulls’ stall and subsequent weakness, triggered by upbeat US ADP jobs data (Aug 195K vs 148K f/c) and non-Manufacturing PMI (Aug 56.4 vs 54.0 f/c) which signaled that the US economy is in good shape and inflated the greenback.

Better than expected ADP data suggest that today’s NFP release may also beat forecast that would increase pressure on the single currency and trigger fresh weakness.

Repeated failure to close above 1.1049 pivot would add to negative signals.

EU GDP data are due today and forecasts for signal easing in Q2 that may add to negative outlook and keep favored scenario on selling upticks on weaker than expected EU and strong US jobs data.

Return and close below daily Tenkan-sen (1.1016) and psychological 1.10 support is expected to reinforce negative signals.

Conversely, bullish signals could be anticipated if US jobs data fall below expectations, with confirmation of scenario seen on lift and close above falling 20DMA (currently at 1.1078).

Res: 1.1049; 1.1078; 1.1087; 1.1103

Sup: 1.1029; 1.1016; 1.1000; 1.0968