Sterling keeps traction but downside remains at risk as negative tone prevails in fundamentals

Cable bounces from a daily low at 1.2430 (the lowest since May 19, after being hit by the story about confidence vote on PM Boris Johnson.

Although Johnson survived the vote, he suffered significant political damage as 41% of Conservative MP’s voted against him, with focus on two elections on June 23, which would further undermine Johnson’s position if Conservatives lose these seats.

On the other side, better than expected UK May Services and Composite PMI’s slightly improved the sentiment and gave a temporary boost to the sterling, despite British businesses continued to slow, as a result of increased pressure from surging inflation.

Also, expectations on more aggressive BOE that would push interest rate to 2.25% towards the end of the year, could keep the pound afloat.

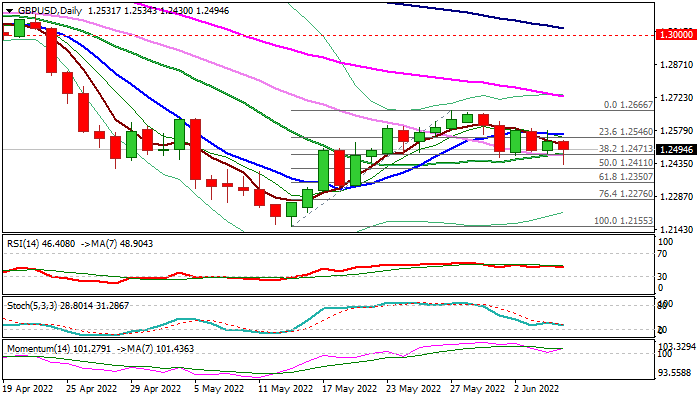

Technical studies are still conflicting as bullish momentum continues to rise and MA’s are mixed, while RSI is just below neutral zone.

Today’s renewed probe through key 1.2470 support (Fibo 38.2% of 1.2155/1.2866 upleg / converged 20/30DMA’s / lows of past four days) was so far rejected, suggesting that initial signal of bear-trap is forming, however lift and close above 10DMA (1.2563) which capped the action in past five days, is needed to confirm positive signal and shift near-term focus higher.

Conversely, sustained break of 1.2470 pivotal support zone would generate fresh bearish signal and risk deeper drop, with loss of 1.2411 (50% retracement of 1.2155/1.2666 upleg) to signal an end of corrective phase from 1.2155 (May 13 low).

Res: 1.2534; 1.2563; 1.2589; 1.2616

Sup: 1.2470; 1.2430; 1.2411; 1.2350