The dollar index remains in red and could drop to 200DMA on close below daily cloud

The dollar index fell further on Tuesday, extending Monday’s 0.8% fall (the biggest one-day drop since 27 Mar).

The greenback weakened across the board on fresh risk demand, sparked by hopes that vaccine for coronavirus might be developed soon, following encouraging signs on tests.

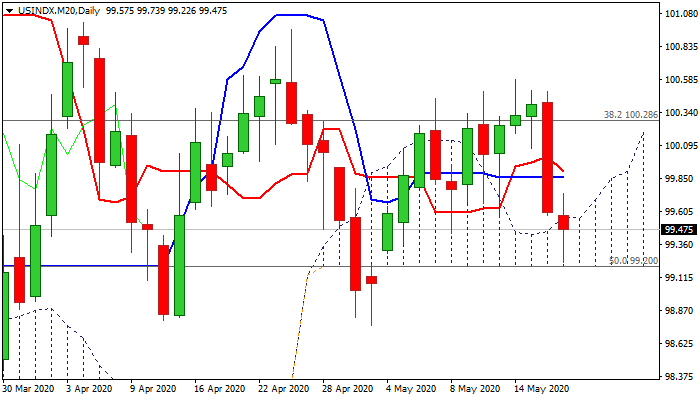

Fresh bearish extension penetrated daily Ichimoku cloud (spanned between 99.57 and 99.20) but cloud base so far containing dip.

Souring sentiment on fresh demand for riskier assets could further depress the dollar and signal eventual exit from larger range the index is entrenched in since late March.

Bears need confirmation on break and close below daily cloud base (99.20) to open way for test of range floor, reinforced by 100DMA (98.75) and possible attack at key supports at 98.32/11 (200DMA / Fibo 61.8% of 94.59/103.79).

Today’s action should end within the cloud to keep bears intact, with stronger upticks to be capped by converged 20/30DMA’s (99.88).

Res: 99.57; 99.88; 100.00; 100.28

Sup: 99.20; 98.75; 98.32; 98.11