Upbeat EU data lift Euro but daily cloud top continues to cap

The Euro regained traction and jumped towards the tops of the range that extends into fourth straight day, following anticipated mild reaction on ECB’s decisions on Thursday.

Upbeat EU PMI data signaled that the bloc’s economy was impacted less than expected from the latest lockdown and accelerated recovery at a higher pace than economists forecasted.

Fresh gains might be limited again (following repeated strong upside rejections this week) as US PMI data showed better than expected results in April that may keep the dollar inflated.

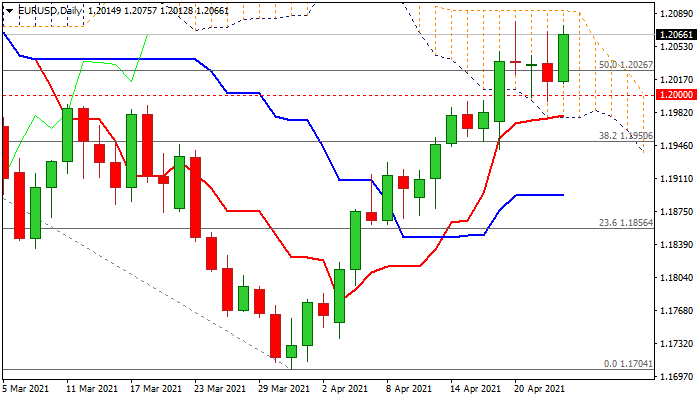

Daily techs remain in bullish mode and keep the focus shifted up, after 1.20 level proved to be strong support and contained dips twice, with significant positive signals seen on weekly chart, as the pair is on track for the third consecutive strong bullish weekly close, while bullish engulfing pattern is forming on monthly chart and adding to positive signals.

However, bulls require confirmation on eventual break and close above descending daily cloud (top of the cloud lays at 1.2089) and lift through pivotal Fibo support at 1.2102 (61.8% of 1.2349/1.1704) that would signal bullish continuation and open way for 1.22+ gains.

Psychological 1.20 level and daily cloud base, reinforced by Tenkan-sen (1.1975) offer solid support and only break here would weaken near-term structure.

Res: 1.2079; 1.2089; 1.2102; 1.2149

Sup: 1.2026; 1.2012; 1.2000; 1.1975