Euro remains afloat but upside is limited; Fed eyed for fresh signal

The Euro regains traction after upside rejection and negative close on Tuesday, lifted by weaker dollar in early European trading on Wednesday.

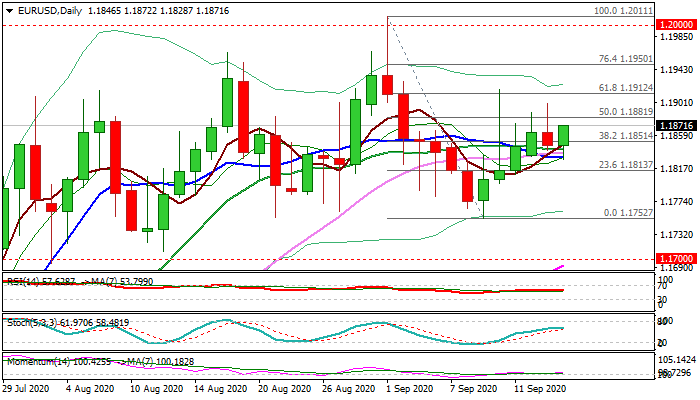

Persisting risk sentiment and rise in German business morale, keep the single currency afloat, but repeated upside failures in past few sessions and daily candles with long upper shadows, warn of strong headwinds and possible stall.

Near-term action struggles to sustain break above 1.1851 pivot (Fibo 38.2% of 1.2011/1.1752) but remains above converged 10/20/30DMA’s (1.1831/46), keeping slight positive bias.

Rising bullish momentum and daily MA’s in positive setup continue to underpin.

Market focuses on Fed’s policy decision, due later today, with expectations for dovish stance from the central bank that could deflate dollar and give fresh boost to Euro.

Res: 1.1881; 1.1900; 1.1912; 1.1950

Sup: 1.1851; 1.1831; 1.1809; 1.1797