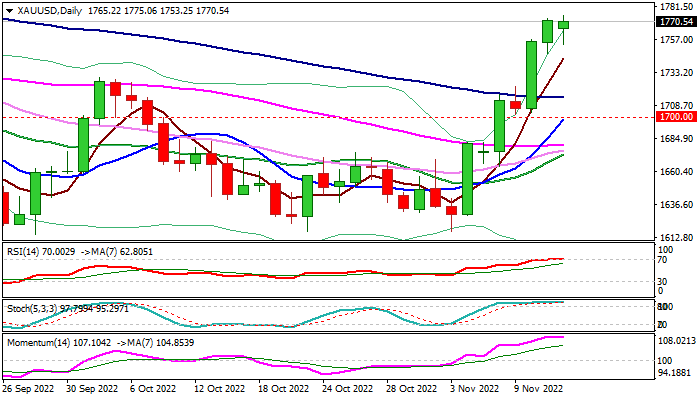

Gold keep firm bullish stance but overbought studies warn

Spot gold dipped some $20 on Monday, following a gap lower opening, but managed to regain traction and probe above last Friday’s peak ($1772), hitting new highest in nearly three months.

The yellow metal advanced nearly 6% last week on growing expectations that lower than expected US inflation in October would prompt the Fed to soften its current aggressive path in raising interest rates, but the latest comments from the US policymakers signaled that the central bank is unlikely to change its current stance, as its primary target is to bring the inflation which is almost four time above 2% target, under control.

Today’s fresh strength after a shallow dip suggests that bulls remain firmly in play to extend recovery from Sep/Nov base at $1616 zone.

Pivotal barrier at $1788 (Fibo 38.2% of $2070/$1614 descend) is in focus, with break here to generate fresh bullish signal and expose next key levels at $1800/03 (psychological / 200DMA).

Caution on overbought daily studies which warn that strong bullish acceleration in past two weeks may lose traction.

Narrow consolidation should ideally hold above rising 5DMA ($1748) while extended dips should find footstep at broken 100DMA ($1714) to keep bulls in play.

Only drop below psychological $1700 (reinforced by rising 10DMA) would sideline bulls and risk deeper drop.

Res: 1775; 1783; 1800; 1803

Sup: 1753; 1743; 1737; 1714