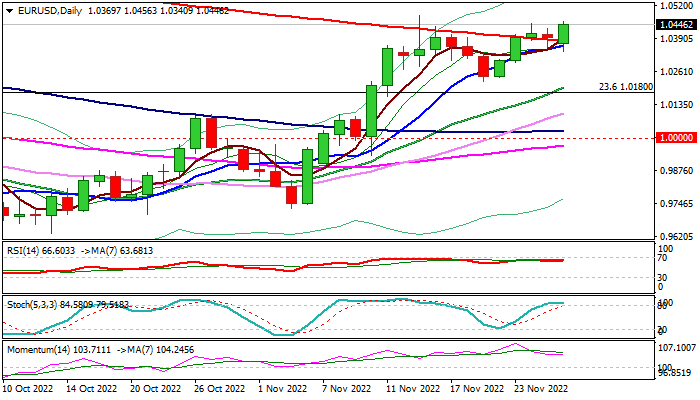

Sustained break above 200DMA signals further advance

The Euro regained traction and jumped on Monday, generating signal that larger bulls are resuming after last Thu/Fri consolidation.

Fresh weakness of the US dollar lifts the single currency and bulls look for attack at key near-term barrier at 1.0481 (Nov 15 high), break of which would expose next key level at 1.0578 (Fibo 38.2% of 1.2266/0.9535 fall).

Repeated close above 200DMA (Thu/Fri) generated bullish signal, which is reinforced by 5/200DMA golden-cross, while 10 and 200DMA’s are converging and on track to form another bullish cross.

Bullish daily studies support the action, though overbought stochastic warns that bulls may face headwinds.

Dips should be limited (ideally to be contained by 200DMA at 1.0383) which guard 10DMA (1.0362) and daily Tenkan-sen (1.0339).

Res: 1.0481; 1.0578; 1.0620; 1.0700

Sup: 1.0383; 1.0362; 1.0339; 1.0238