The dollar falls sharply on renewed risk mode and expectations for dovish Fed

The pair accelerated lower on Monday, with 0.5% daily loss seen so far and on track for the worst day since 28 Aug.

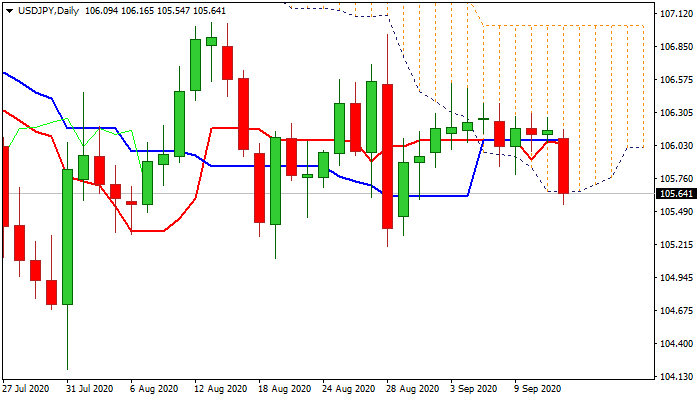

Bears were boosted by break of last week’s low (105.79) and the base of thick daily cloud (105.65) with today’s close below the cloud to generate fresh bearish signal.

Daily studies maintain strong negative momentum and along with south-heading RSI / Stochastic and MA’s in full bearish configuration, support scenario.

Bears eye next pivotal supports at 105.28 (Fibo 61.8% of 104.18/107.04) and 105.20/10 (28/19 Aug lows), with further weakness seen likely on break of these levels.

Markets focus this week’s key events: Fed and BoJ policy meetings, with BoJ seen unchanged while the US central bank is expected to re-affirm its strong easing bias, after the central bank announced the main steer in its approach to policy and inflation in Jackson Hole symposium last week, that would keep the greenback at the back foot.

Res: 105.79; 105.95; 106.16; 106.37

Sup: 105.54; 105.28; 105.10; 104.86